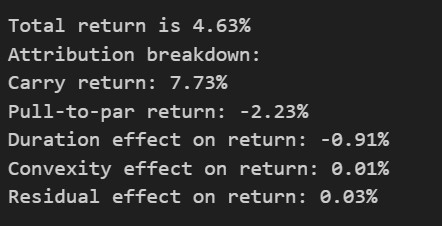

It is common for fixed income holders to want to understand what contributes to their fixed income securities return. Hence, this project develops a framework to break down the return from the fixed income securities. Specifically, it is broken down as follows:

- Carry: this is the yield earned fixing the yield curve

- Pull-to-par: this is the market value movement as the portfolio slide down the yield curve

- Duration: this is the pnl from parallel interest rate/z-spread movement

- Convexity: this is the second order impact from the parallel interest rate/z-spread movement

- Residual: as the duration moves continuously with interest rate, the duration-convexity calculation is only an approximation, and there will be high order residuals. The residuals are expected to be small if the interest rate movement is small.